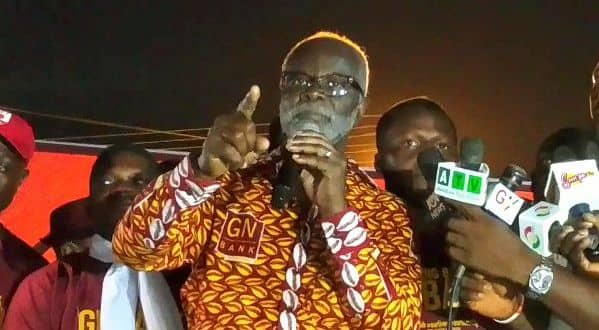

The founder of GN Bank, Dr. Paa Kwesi Nduom has charged residents of Elmina in the Central Region to vote massively for the political party which has shown the efficiency of bringing back defunct GN Bank when elected into power.

In the country's quest to elect its new leaders come Saturday, December 7, Dr. Nduom has urged residents of Elmina to vote for the party which has shown beyond all reasonable doubt to help GN Bank bounce back to its feet.

He said this following a 'Bring Back GN Bank' procession across the principal streets of Elmina on Monday, December 2, 2024, an activity which garnered a huge crowd of Elmina residents, devoid of their political affiliations.

Speaking at a rally after the procession, Dr. Paa Kwesi Nduom remarked in anguish that no bank in Ghana have been able to match up the operations of GN Bank even till its defunct state.

He again issued a stern warning to the sitting government regarding the revoked license of his bank, asserting in plain language that "if you don't give us back our bank, the next government will."

John Quayson, popularly known as 'Manoma' who at the rally spoke as a Leading Member of Elmina, accused Nana Kodwo Conduah VI, the Omanhene of Edina Traditional Area of being a party to the jeopardizing of Dr. Paa Kwesi Nduom's GN Bank.

According to him, Nana Kodwo Conduah should have led delegation to seek the welfare of the business of his own, Dr. Nduom, but has over the years acted adamant to the revoked license of GN Bank after several encounter with President Nana Akufo-Addo and even failed to address the issue of GN Bank before the President at the 2024 Edina Bakatue Festival, upon gracing the occasion.

The operational license of GN Bank was revoked in 2019 together with other 22 savings and loans banks, described by the Central Bank of Ghana to be facing liquidity crisis, coupled with other violations.

Insolvency

GN Bank was unable to meet the minimum regulatory capital requirement of GHS400 million by the end of 2018, set by the country's Central Bank.

Liquidity Crisis

According to the Bank of Ghana (BoG), GN Bank was experiencing a severe liquidity crisis which led to the revocation of its license in 2019.

Regulatory Violations

GN Bank following a findings conducted by the BoG, was said to have committed numerous regulatory violations.

Complaints

The Financial Stability Department of the BoG asserted to have received complaints that GN Bank was unable to pay deposits on demand.

The BoG defended its decision, stating that it was made in the interest of protecting the banking sector.

The BoG during GN Bank's liquidity challenges, requested it to be reclassified as a Savings and Loans company.

The Court of Appeal upheld the BoG's decision to revoke GN Bank's license, and referred the matter to arbitration where the court ruled that the forum for challenging the decision was arbitration, not the court.

The court also ruled that the applicants had misrepresented their challenge as a human rights application.

Sompaonline.com/Eric Annan

Sompaonline.com offers its reading audience with a comprehensive online source for up-to-the-minute news about politics, business, entertainment and other issues in Ghana

Sompaonline.com offers its reading audience with a comprehensive online source for up-to-the-minute news about politics, business, entertainment and other issues in Ghana